PayCheck Records is a web-based portal that permits company employees & individual, business owners to view pay stubs. This is a safe and secured online account that you can easily view, access, and print your present and past pay stubs.

However, if you wish to access this PayCheck Records account, your employer must authorize you to access this service. This online platform is launched by an employer to meet the payment/salary agreed between the employer and the employee during his employment period.

PayCheck Records application is managed by Intuit Incorporation. Intuit has its expertise in financial software and was founded in the year 1983 by Mr. Scott Cook, and Mr. Tom Proulx. It is a United States-based company located in Mountain View, California, and primarily sells finance, accounting, and tax preparation software.

Paycheck Records Login Guide

PayCheck Records is currently known as the QuickBooks Workforce. This Employee login portal is a secured online platform to view your payroll stubs. Here employees can easily access all current & past PayCheck Records at will. But to access your portal account, your current organization manager must add you as an employee or contractor.

Using your PayCheck Records Accounts, you can easily review your official documents and to access this portal please make sure they meet the requirements needed. As an employee, you must update the relevant job or task updates on the platform within 6 years of your employment.

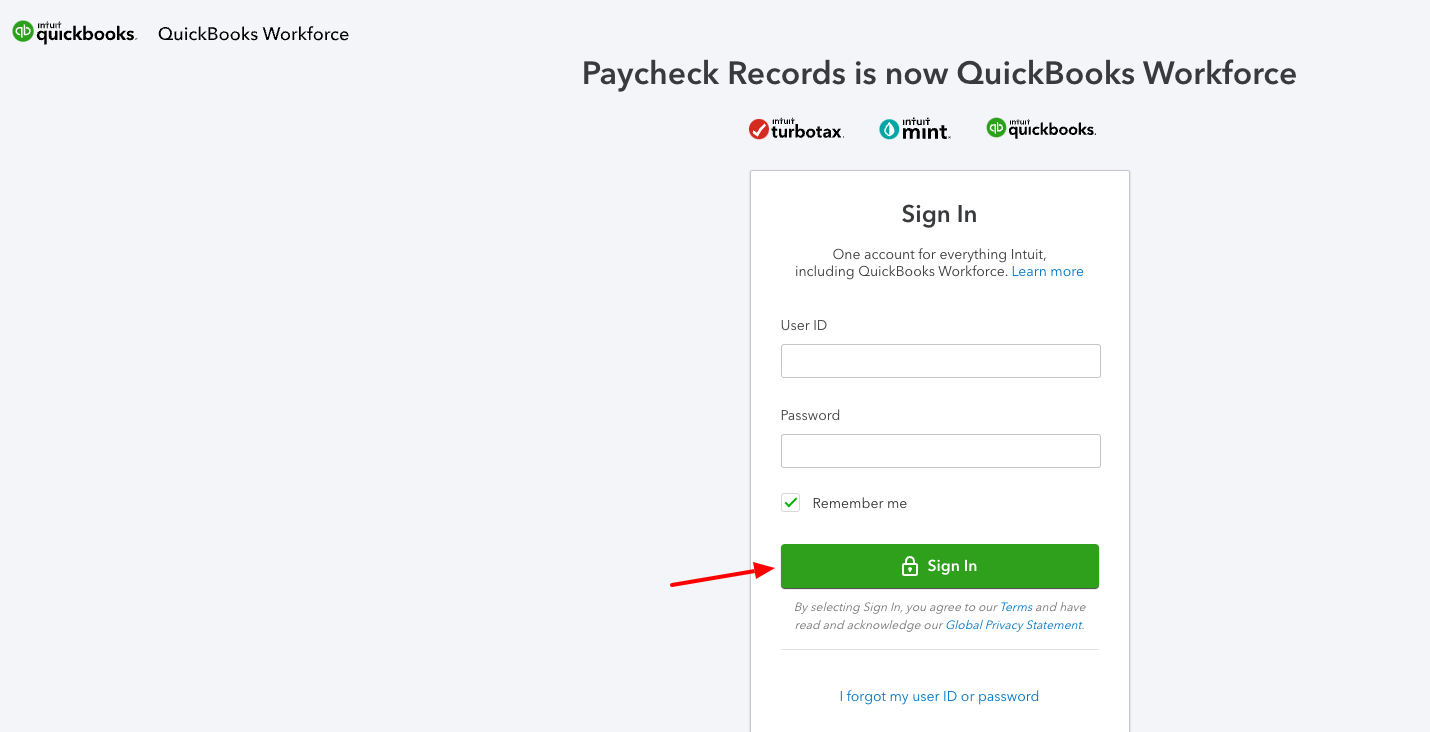

If you wish to Log In for the PayCheck Records Portal Employee Account, please go through the below process:

- First of all, visit the official Employee Log In web portal of PayCheck Records.

- You can also directly tap on the link at paycheckrecords.com.

- Here on the landing web page, you will need to enter your Company’s “User ID” and “Password”.

- Please enable the option “Remember Me” only on a personal system/device. (If you enable this option, you will secure your login credentials on the system).

- After reviewing the above information, by tapping on the “SIGN IN” button, you will be redirected to your PayCheck Records account and enjoy all the services offered on this portal.

How to Reset your Forgotten User ID and Password for the PayCheck Records Account

The PayCheck Records LOG IN web portal is an online payslip application that an employee of an organization or individual legal representatives can utilize effectively to check their pay stubs.

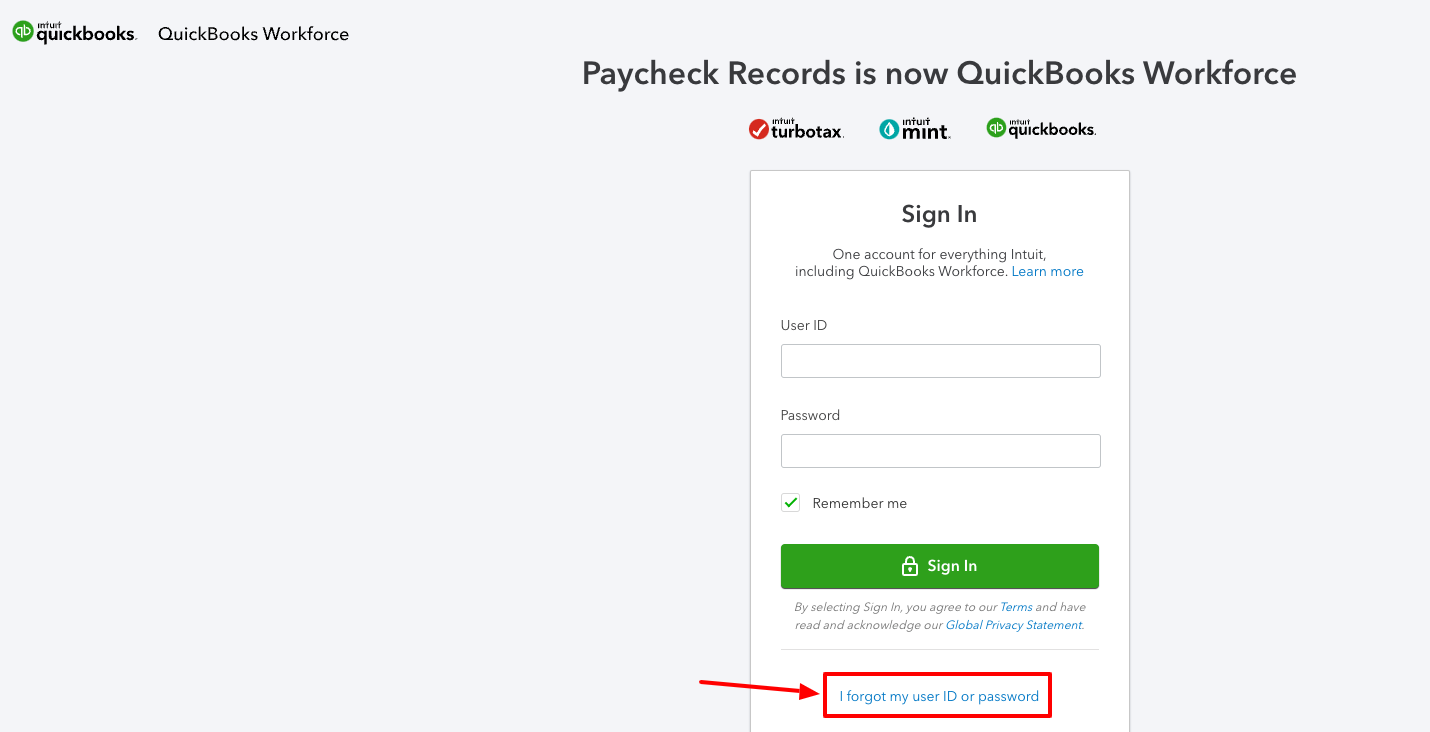

If you have somehow, forgotten or lost your PayCheck Records Employee Account login information, follow these simple steps to get the details:

- Straightly, move to the Log In web page of the PayCheck Records Employee Account.

- Here on the SIGN IN web page, tap on the link “Forgot User ID or Password”

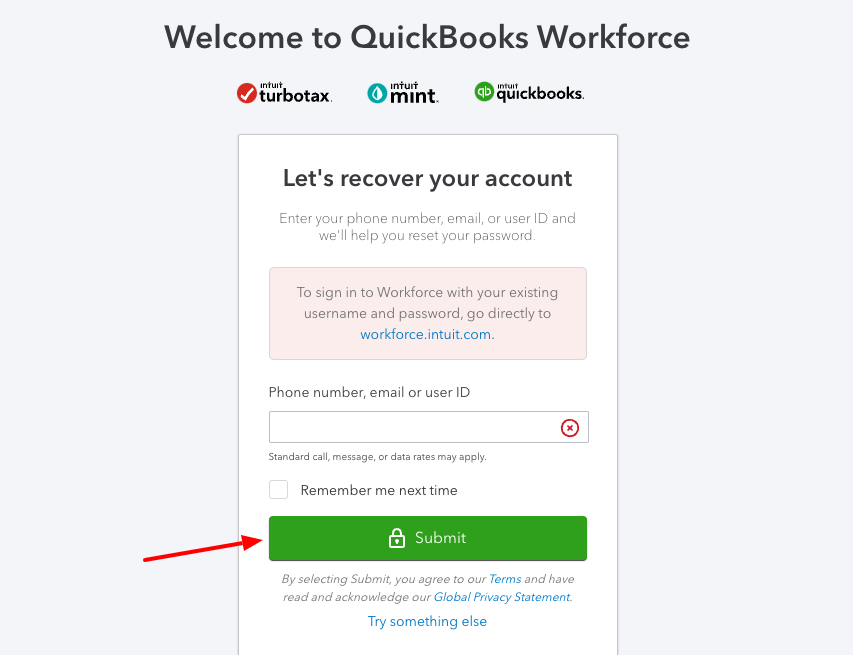

- Now being deferred on the next page, under the Welcome to Quickbooks Workforce put down your Phone Number, E-mail Address, or User ID on the blank space.

- And lastly, by tapping on the “SUBMIT” button below, follow the on-screen process to recover or reset your User ID and Password for the PayCheck Records Employee Account.

What Pay Stubs information should Employers keep in PayCheck Records Portal

According to the rules of the United States Department of Labor, the Fair Labor Standards Act (FLSA), every registered employer requires the following records to be maintained for each non-exempt employee:

- Employee’s Identification data such as Full Name, Social Security Number (SSN), Home Address, ZIP Code, Date of Birth (DOB – if an employee is under 19 years of age), Gender, Occupation, etc.

- Employee’s Working Hours such as – Time & Day of the week the employee’s workweek begins. The hours an employee has worked each day & the total number of hours for each workweek.

- Employee’s Wages & Income Details i.e. the basis on which employee wages are paid.

- Employee’s Pay Periods i.e. the total salary paid during each period covered by salary, pay period, and pay date.

- Employers will need to keep employees’ personal records, like a resume, cover letter, copies of the job application, and employee certificates.

- Furthermore, employers must keep signed copies of each employee’s Form W-4 showing federal withholdings and any forms displaying deductions from donations, wages, and company benefits.

Services offered by PayCheck Records

- PayCheck Records Application: It is officially managed by Intuit Inc. so you can also find the products & services that this company offers.

- Quicken Application: A personal financial administration programming, available in Home & Business variants for Cash Managers.

- Premier Editions and Profile Basic: Another service for Packages of Professional Tax Preparation.

- QuickBooks Succès PME: A French language variant of QuickBooks, offers many services.

- QuickBooks Succès PME Service de paie: It is a French-language edition of Employee Payroll Solutions.

- QuickBooks Enterprise Solutions: This bookkeeping application is dedicated to average-sized organizations that require greater financial limits, practicality, and backing than is offered by conventional independent company programming.

- QuickBooks Online:This is a web-based private company accounting and money-related administration solution that is offered in EasyStart, Essentials, and Plus versions.

- TurboTax: A facility offered in Basic, Standard, and Premier Versions, for Home & Business for setting up various returns.

- Snap-Tax: It is an iPhone app that allows customers to manage their personal expense forms on their iPhones.

- QuickBooks:A small business accounting and budgetary administrative programming, offered in EasyStart, Pro, and Premier Versions.

- QuickBooks Payroll Solutions: It is an in-house finance solution providing programming that is an advanced version of QuickBooks Pro and Premier.

- Intuit Merchant Service for QuickBooks: This application lets you process credit and charge exchanges that are legitimately in any rendition of QuickBooks.

Frequently Asked Questions (FAQs)

How to view your Pay Stubs on the PayChecks Records Portal

- First, you need to set up your QuickBooks Workforce account if you haven’t before.

- Then just “Sign In” to paycheckrecords.com

- Here on the platform choose the “PayChecks”

- Now choose the “Appropriate Date Range”, options for viewing multiple PayChecks up to one year at a time are available.

- You can click on the “Download”tab on the pay stub you wish to download and print, or to open and view.

How to change your E-mail Address or Password on the PayChecks Records Portal

If you want to change your E-mail Address or Password for your Intuit Account (i.e. PayChecks Records). Follow the proceedings:

- LOG IN to your account and go to the “Settings”

- Then choose the “Account Settings”

- Then select the option “Sign In & Security or Personal Info” to change your E-mail Address or Password as you required.

Please Note: Changing your E-mail or Password, will change your login credentials with TurboTax, Mint, or other Intuit products you are currently using. This Updation will not change the E-mail Address your employer has on file.

How to Change My Personal Info?

You’ll require to contact your present employer to make changes to your Name, Address, W-4 Form, Bank Account details, etc. Your Employer can simply go through the steps in “Add or Edit” an employee.

How to Delete your Account on the PayChecks Records Portal?

To delete your personal data on the QuickBooks Workforce, you can make a request. Please note that once your information is deleted, the portal won’t be able to recover it back for you.

- You will need to LOG IN to your QuickBooks Workforce Account.

- Move on to “Settings”, and choose “Account Settings”.

- Here you’ll be diverted to @accounts.intuit.com. And from the left “MENU”, choose the “Data Privacy”

- Now tap on the “Delete” option, then select “Make a Delete Request” to follow.

Why can’t you see all of your Pay Stubs from your Employer?

- There may be a few reasons, why you can’t see all of your pay stubs on the platform.

- Primarily, check with your current employer.

- Your employer may require, little time to upload your prior pay stubs.

- Additionally, your employer may have changed or switched payroll services with PayChecks Records. This is quite common at the beginning of a new year and in these circumstances, you won’t be able to see pay stubs from the prior year.

Contact Details

Intuit Inc. (Headquarters Address):

2700 Coast Ave,

Mountain View, CA 94043, United States

Office Phone Number (Call): +1 -650 -944 -6000

Office Fax Number (Dial): (650) -944 -5656

USA Offices at

Intuit Incorporation, Los Angeles

21650 Oxnard Street, Suite #2200

Woodland Hills, CA 91367, United States

Office Phone Number (Call): 818 -936 -7800

Intuit Incorporation, New York

57 E 11th Street, Floor 6,

New York, NY 10003, United States

Intuit Incorporation, Washington D.C.

601 Pennsylvania Ave. NW

North Building, Suite 520,

Washington, D.C. 20004, United States