Tangerine Bank – An Introduction:

The antecedents of the Tangerine group were ING Bank of Canada (which worked as ING Direct) was established earlier in April 1997. The organization started working as a telephonic banking system, offering investments and savings bank accounts. It was a primary test market operation for ING Group’s direct business banking model. The organization’s prime target was to offer more good rates and interests to clients by avoiding the expenses of running a chain of branches.

Working without conventional bank offices, ING Direct group rather opened a little organization of ING Direct Cafes popularly known as contact centers, for its direct client interactions. In the year 1997, the first cafe was opened in Toronto.

Tangerine Bank, working as Tangerine, is a Canadian direct bank and an auxiliary of Scotia Bank was taken over in November 2012. The bank’s new name started its journey in April 2014.

Step by step guide – How to Sign Up for Tangerine Credit Cards:

The users have to first complete the Sign-up process to Log in, Apply, and Activate a Tangerine Credit Card. So first things first, let’s follow the simple process:

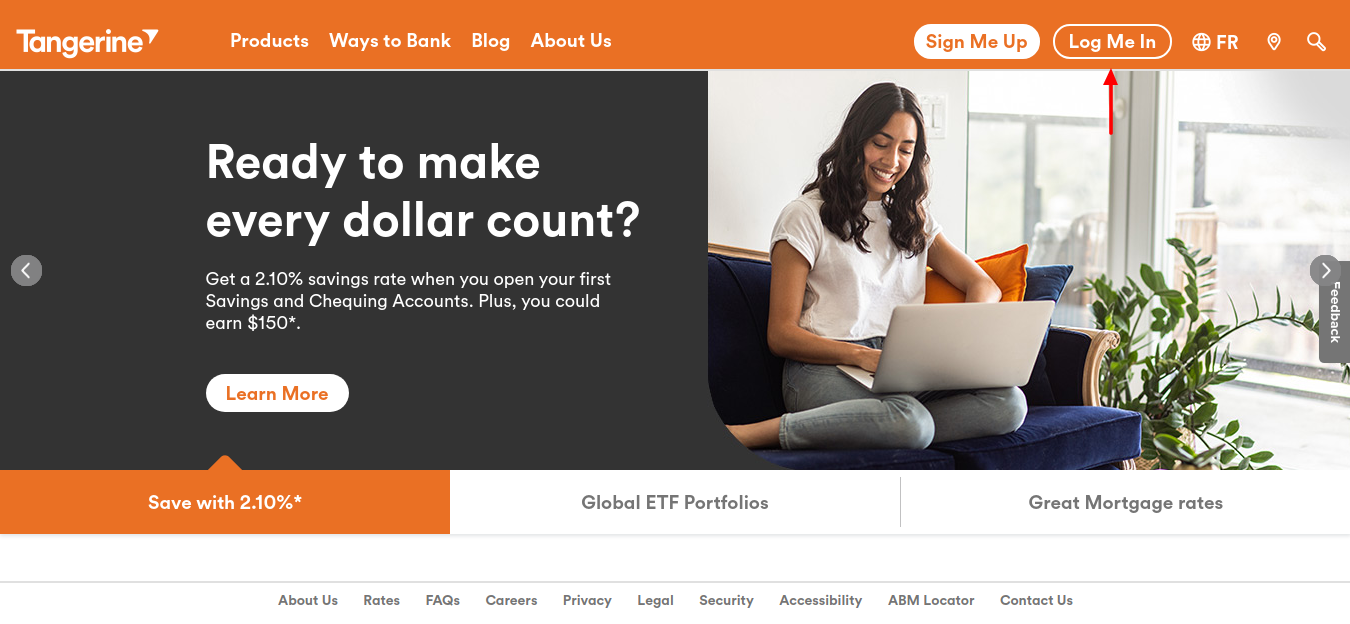

Firstly, you have to visit the official website of Tangerine.

Or you can click on the link www.tangerine.ca

- On the top right of the webpage, find the “Sign Me Up” button.

- After clicking the option, on a new page, they will find “Get Started” under Sign up through the website heading.

- Tapping on “Get Started”, users will again be diverted to a new webpage.

- There they have to fill in some simple information like Email address, Create a 6 (six) digit banking PIN, Enter Promo Code or Orange key (optional), etc.

- Then click on the “Next” button.

- Follow the instructions and fill up the Personal Info, address Info, Review, and Submit to complete the “Sign Up” process.

Step by step guide – How to Apply for Tangerine Credit Cards:

Visit the official website of Tangerine.

Or click on the link given www.tangerine.ca

- You will find the “Products” option on the top of the webpage.

- After clicking the option, on a new page, you can find “Learn More” under the Credit Card heading.

Clicking on the “Learn More” option you will be diverted to a new page.

Here you can find your choice of cards and Apply.

Step by step guide – How to Activate the Tangerine Credit Cards:

After you logged in, you can see a message near the top of the screen prompting you to activate your Tangerine Credit Card. Tap on the “Activate Card” button and follow the instructions to complete the process.

You can also activate your Credit Card by going to their respective Credit Card Account and click the “Activate” button.

Or, if the end-user may prefer, they also can activate your Card by calling 1-866-700-4610.

Various Credit Cards offered by Tangerine:

The Credit cards offered by the Tangerine group are as follows:

Money-Back Credit Card

Features and Advantages:

You can earn a money back reward of 2% on your daily transactions.

All your money-back rewards are automatically earned on daily transactions and are paid on monthly basis.

Your earned rewards are deposited directly on your Tangerine savings account and get a 3rd 2% cashback category.

Low rate of interest on transfer balances for the first 6 (six) months.

The 2% money-back categories for this card are Grocery, Furniture, Restaurants, Hotels and Motels, Gas, Recurring bill payments, Drug store, Home improvement, Entertainment, and Public Transportation and Parking, etc.

Eligibility Criteria:

Your Gross income should be $12,000 or more annually.

You should be an adult as per the norms of your respective province.

A permanent Canadian residentship is a must to apply for Tangerine Credit Card.

You should have a clear record of bankruptcies over the past 7 (seven) years.

Also Read : How To Activate a Rogers Credit Card

Rates and Interest:

The company charges a 0% annual fee on Money-Back Credit Card.

You can get rewards for up to 2% on transactions.

An interest rate of only 1.95% is charged on the transfer of balances for the first 6 (six) months and afterward 19.95% is charged.

For foreign currency conversion, a rate of 2.50% is charged.

- A rate of $3.50 (within Canada) and $5.00 (Outside Canada) is charged on Cash Advances.

On Cash Advances, a rate of 19.95% is charged as interest.

For Dishonoured payments, a rate of $25 is charged.

For Cash, over limits, a rate of $25 is charged.

Rush cards are charged at a rate of $25.

And for the Past Statement reprint, $5 per statement is charged.

Tangerine World Master card:

Features and Advantages:

The Tangerine world Master Card helps you to connect and access over 1 million Wi-Fi hotspots throughout the world with Bingo Wi-Fi.

You get protection on your tablets, smartphones, etc when the company charges a full cost to their card. The card also covers up to $1000 if your mobile device is theft, lost, accidentally damaged, or faces an uncertain mechanical failure.

Low rate of interest on transfer balances for the first 6 (six) months.

The money-back amount of rewards has no limits.

The 2% cash-back categories for this card include Restaurants, Grocery, Furniture, Hotels and Motels, Recurring bill payments, Gas, Drug store, Home improvement, Entertainment, and Public Transportation and Parking, etc.

You can track and categorize your expenses every month and stay on top of your spending, so you can watch their financial habits.

- You can get your rewards deposited directly into the Tangerine Savings Account and get a 2% Money back category.

If the Tangerine World Master card is misplaced or lost, without any worry you can temporarily suspend it online.

The card protects the car rentals when you rent cars for up to a consecutive 31 days and pays the full cost of rental using the card.

- While traveling out of Canada, you can unlock money-back offers and also avail of special rebates applied directly to their monthly statements, by using the tangerine world Master card at some selected shops, where accepted.

- Master cards are accepted worldwide at more than 24 million locations in over 210 countries.

Eligibility Criteria:

You should meet at least One Tangerine World Master card eligibility criteria:

Your Gross income should be $12,000 to $60,000 or more annually.

The Household income should be $100,000 or more.

- You should have a total balance of $250,000 or more in Tangerine Savings Accounts and/or in Investment Fund Accounts.

You should be an adult as per the norms of your respective province.

A permanent Canadian residentship is a must to apply for Tangerine Credit Card.

You should have a clear record of bankruptcies over the past 7 (seven) years.

Rates and Interests:

The company charges a 0% annual fee on Money-Back Credit Card.

You can get rewards for up to 2% on purchases.

- An interest rate of only 1.95% is charged on the transfer of balances for the first 6 (six) months and afterward 19.95% is charged.

On Cash Advances, a rate of 19.95% is charged as interest.

For Dishonoured payments, a rate of $25 is charged.

For Cash, over limits, a rate of $25 is charged.

Rush cards are charged at a rate of $25.

And for the Past Statement reprint, $5 per statement is charged.

Tangerine Credit Card – How to Log in:

Go to the official website of Tangerine.

Or otherwise, click on the link www.tangerine.ca

You can find the “Log Me In” option on the top right of the webpage.

- After clicking the option, find “Personal Banking Login”, under the Sign up through the website heading.

Here you have to enter your Client Number, Card Number, or User name, etc.

- Tap on the option “Log Me In” button, follow the instruction to complete the process.

Contact Details:

Tangerine Cafe (For face to face contact) and For Mail:

3389 Steeles Ave, East

Toronto, Ontario, M2H 0A1

Phone number: 416 -758 -5344

Customer Service (Toll-Free):

Phone number:

(Service in English) 1 -888 -826 -4374 and 416 -756 -2424

(Service in French) 1 -844 -826 -4374

To Reset Login Secret Questions (Call): 1 -888 -723 -3304 (Service in English and French)

Tangerine Credit Card Services (Call): 1 -888 -826 -4374

Call for Collection (For outside Canada): 416 -758 -3139 (Service in English and French)

Reference Link: