How to Activate a Capital One Credit Card Online

How to Apply for Capital One Credit Card

To apply for the Capital One credit card you have to follow the underneath steps:

- First, visit the official website of Capital One. Or else,

- Click on the link www.capitalone.com.

- Now, you can select the “Credit Card” option, on the top.

- Choose, your credit card, under “Types of credit cards”.

- You will be flipped to a new webpage.

- Here, you can see the features of your chosen card, and “Apply”.

How to Activate a Capital One Credit Card

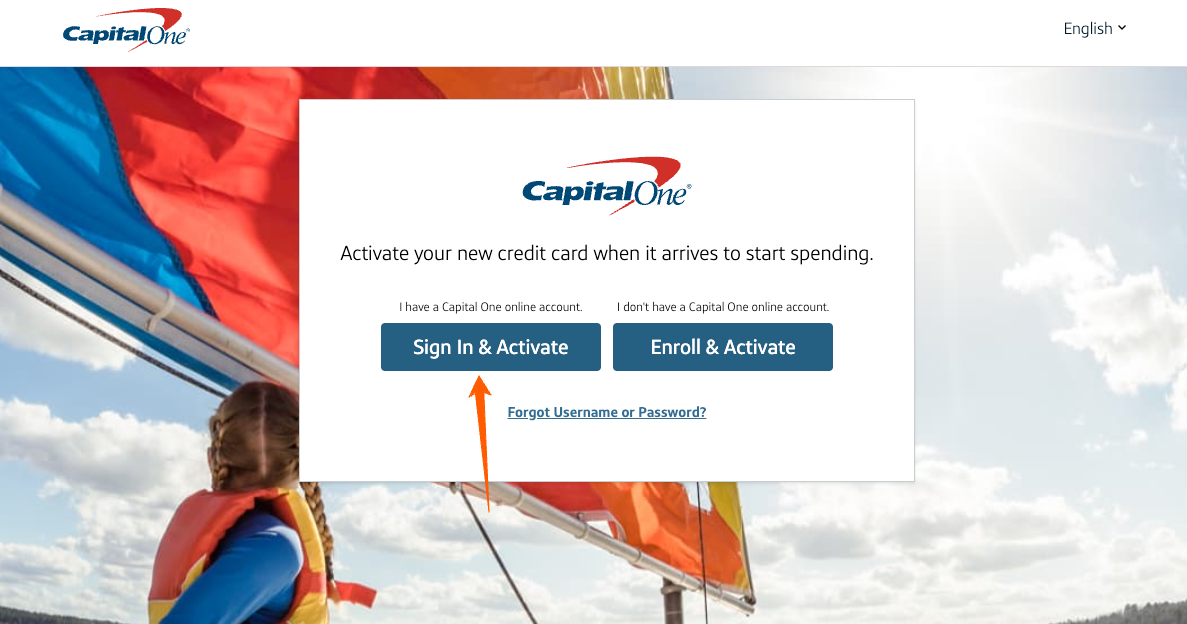

If you already have a Capital One online account, you can go to www.capitalone.com/activate

- Then click on the “Sign In and Activate” button.

simply by following some screen-prompted instructions.

If you don’t have a Capital One online account, then you have to first “Enroll or Register” yourself for the online account, and then you can activate your credit card simply by following some screen-prompted instructions.

Activation via Phone

You can also activate your credit card, using your registered phone number by calling the bank’s automated telephonic system. You have to call 1 -800 -227 -4825 and follow the instructions to complete the process.

How to get Enrolled or Registered for Capital One Credit Card

To apply for the Capital One credit card you have to follow the underneath steps:

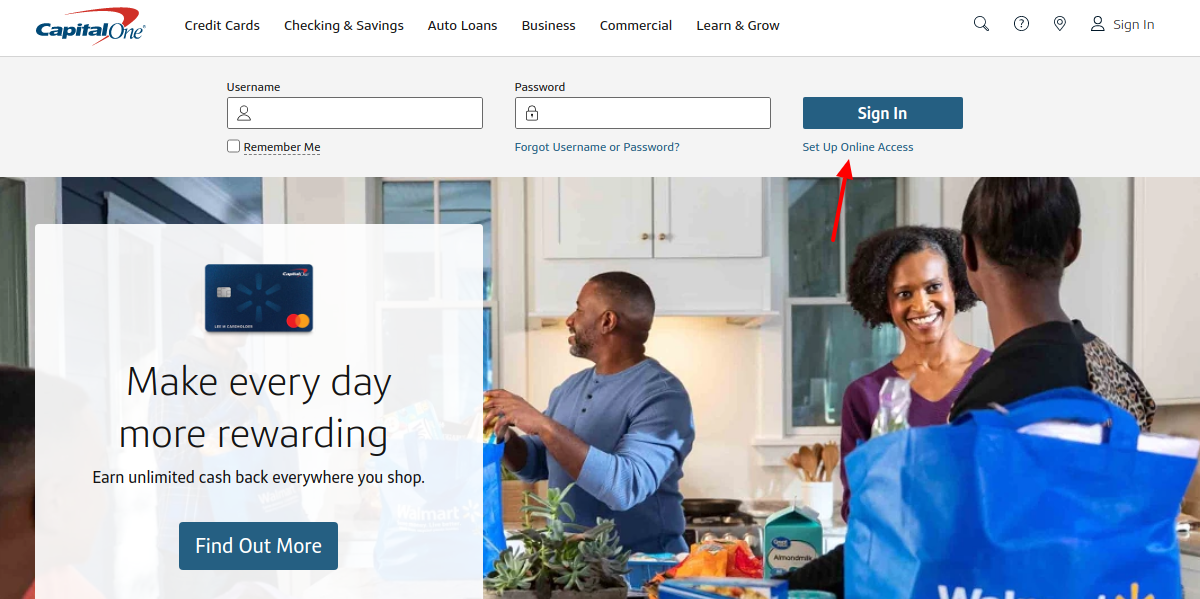

- Firstly, visit the official website of Capital One. Or else,

- Click on the link www.capitalone.com.

- Select the “Set up Online Access” option, on the top, below the Sign-in button.

- You will be deflected to a new webpage.

- Watch out for, “Get started by telling …………. you”.

- Now, you have to put on your Last name, Social Security / ITIN or bank Account number, and Date of Birth.

- Then press the “Find Me” tab.

- Now, follow the screen-prompted simple instructions to get enrolled or registered.

Also Read

How to Access Halifax Credit Card Login Account

Credits Cards offered by Capital One

Various Credit Cards are offered by Capital One Bank, some of them are briefly discussed below:

Capital One – Travel and Miles Rewards Credit Card

The Capital One Bank is offering 3 (three) types of a credit card under this category:

- Venture Rewards

- Venture One Rewards

- Venture One Rewards for Good Credit

Features and Advantages

- You can get an unlimited 1.25 to 2X miles per dollar on your regular purchases.

- You can earn an introductory 25,000 to 60,000 bonus miles, once you spend $500 to $3,000 on purchases within the first 3 (three) months from account opening.

- Receive from $0 to $100 credit for Global Entry or TSA Prev, using your Venture card.

- You can receive an emergency card replacement and a cash advance, in any case, your credit card is lost or stolen.

- You can get insurance coverage, for auto rental collision damage or theft when you rent an eligible vehicle using this card.

- You are covered with insurance, for an emergency travel accident at no extra cost, when you purchase your fare using this card.

- You can avail of additional warranty protection at no charge on eligible products, which are purchased using this card.

- You can redeem your rewards with PayPal.

Rates and Interests

- Charges are applicable for an annual fee of $0 (no fee) to $95, for using this card.

- You have to pay 3% of each transferred balance amount.

- You will be charged $10 or 3% of each cash advance amount, whichever is greater.

- A penalty fee of up to $40, for late payment, can be charged.

- You can be charged with an Annual Percentage Rate (APR) of 17.24%, 21.99%, or 24.49% for purchases depending on your creditworthiness. This APR rate may vary with the market based on the Prime Rate.

- You can be charged 24.49% APR for cash advances.

- You need not pay any fees ($0) when you make purchases outside the United States.

- You don’t need to pay any interest on new purchases if you pay your previous balance in full by the due date of each month. (Due date is at least 25 days after the closing of each billing date).

Phone Numbers

Customer Service (Call): 1 -800 -227 -4825 (For servicing of existing accounts only)