How to Apply For Capital One Credit Card

How to Apply for Capital One Credit Card

To apply for the Capital One credit card you have to follow the underneath steps:

- First, visit the official website of Capital One. Or else,

- Click on the link www.capitalone.com.

- Now, you can select the “Credit Card” option, on the top.

- Choose, your credit card, under “Types of credit cards”.

- You will be flipped to a new webpage.

- Here, you can see the features of your chosen card, and “Apply”.

How to Activate a Capital One Credit Card

If you already have a Capital One online account, you can “Sign In” and activate your card

simply by following some screen prompted instructions.

If you don’t have a Capital One online account, then you have to first “Enroll or Register” yourself for the online account, and then you can activate your credit card simply by following some screen prompted instructions.

Activation via Phone

You can also activate your credit card, using your registered phone number by calling the bank’s automated telephonic system. You have to call at 1 -800 -227 -4825 and follow the instructions to complete the process.

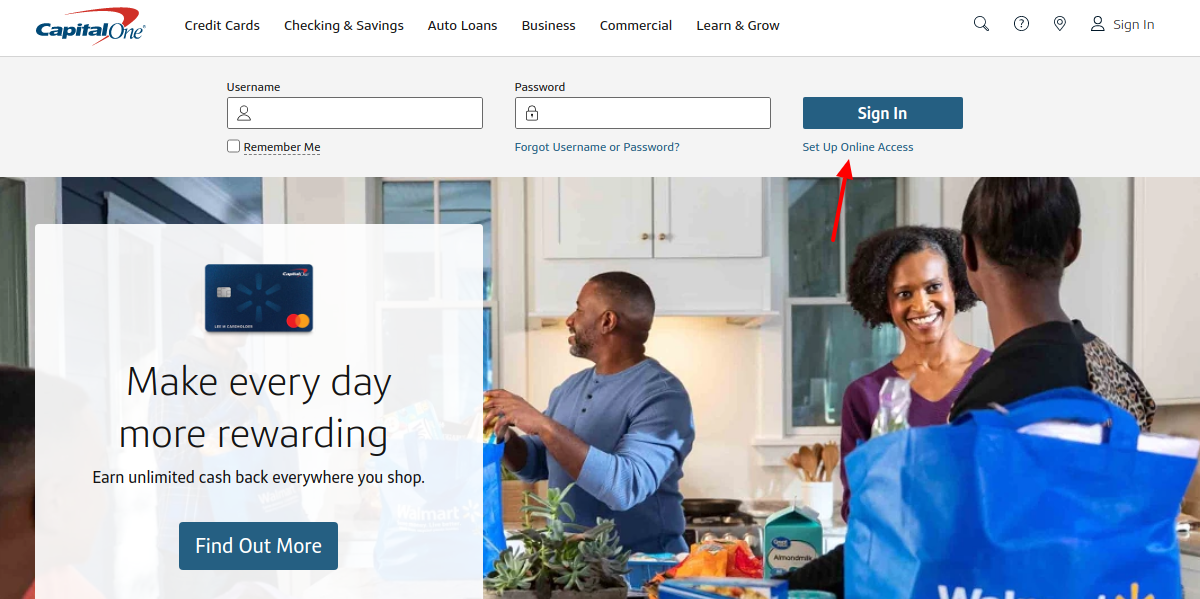

How to get Enrolled or Registered for Capital One Credit Card

To apply for the Capital One credit card you have to follow the underneath steps:

- Firstly, visit the official website of Capital One. Or else,

- Click on the link www.capitalone.com.

- Select the “Set up Online Access” option, on the top, below the Sign-in button.

- You will be deflected to a new webpage.

- Watch out for, “Get started by telling …………. you”.

- Now, you have to put on your Last name, Social Security / ITIN or bank Account number, and Date of Birth.

- Then press the “Find Me” tab.

- Now, follow the screen prompted simple instructions to get enrolled or registered.

Some Credits Cards offered by Capital One

Various Credit Cards are offered by the Capital One Bank, some of them are briefly discussed below:

Capital One – Travel and Miles Rewards Credit Card

The Capital One Bank is offering 3 (three) types of a credit card under this category:

- Venture Rewards

- Venture One Rewards

- Venture One Rewards for Good Credit

Capital One – Unlimited Cash Back Credit Cards

The Capital One Bank is offering 6 (six) types of a credit card divided into 2 (two) main categories:

Savor and Savor One Rewards

- Savor Rewards

- Savor One Rewards

- Savor One Reward for Good Credit

Quicksilver and Quicksilver One Rewards

- Quicksilver One Rewards

- Quicksilver Rewards for Good Credit

- Quicksilver Rewards

Features and Advantages:

- You can earn up to 3% – 4% cashback on dining and entertainment, 2% on daily purchases on grocery stores (excluding superstores like Wal-Mart and Target), and 1% on other transactions.

- You can also earn a one-time $250 to $300 cash bonus when you spend $500 to $3,000 on transactions within the first 3 (three) months of your account opening.

- You can get insurance coverage, for an emergency travel accident at no extra cost, when you purchase your fare using this card.

- You can get additional warranty protection at no charge on eligible products, which are purchased using this card.

- You need not pay any transaction fee ($0) while purchasing outside of the United States.

- You can get 24 X 7, travel Assistance Services like emergency card replacement and cash advances, in case your card is lost or stolen during the travel period.

- You can enjoy comprehensive, customized assistance in dining, entertainment, and travel 24 X 7, and 365 days a year with these credit cards.

- You can receive a push notification, every time a new purchase is approved on your account.

- You can enjoy shopping with your rewards.

- You can redeem your rewards with PayPal.

Rates and Interests:

- You can be charged an annual fee from $0 to $95, using these cards.

- You have to pay an annual percentage rate (APR) from 15.99% to 26.99% variable APR on your purchases.

- You are charged between 15.99% to 26.99% variable annual percentage rate (APR) on your transfer of balances.

- The bank charges $0 (no fee) for the transfer of balances on these cards.

Capital One – Credit Cards to Build Credit

The Capital One Bank is offering 4 (four) types of a credit card under this category:

- Platinum Master card

- Quicksilver One Rewards

- Journey Students Rewards

- Secured Master card

Features and Advantages:

- You can earn an unlimited 1% to 1.5% cashback on everyday purchases.

- You can boost your cash back up to 1.25% by paying your dues on time.

- You can set up a personalized email or text message reminder to self help yourself to stay on top of your accounts.

- You can avail of the facility of an Autopay for your account and your payments will be made automatically each month.

Rates and Interests:

- You can be charged an annual fee from $0 to $39, using these cards.

- You have to pay an annual percentage rate (APR) up to 26.99% variable APR on your purchases.

Capital One – Business Rewards Credit Cards

The Capital One Bank is offering 5 (five) types of a credit card under this category:

- Spark 2% Cash

- Spark 2X Miles

- Spark 1.5% Cash Select

- Spark 1.5X Miles Select

- Spark 1% Classic

Features and Advantages:

- You get a cash bonus of $200 to $500 once you spend $3,000 to $4,500 in the first 3 (three) months from your account opening.

- You can earn a bonus of 20,000 to 50,000 miles, once you spend $3,000 to $4,500 using these cards within the first 3 (three) months from your account opening.

- An unlimited 1% to 2% cashback on every purchase you make using these cards, without any minimum purchases or expiry date.

- You may earn 1.5X to 2X unlimited miles rewards on every purchase you make, without any minimum purchases or expiry date.

Rates and Interests:

- You are offered an introductory $0 (no fee) for the first year and then after $95 as an annual fee, using these cards.

- You get an introductory 0% (no fee) APR on your purchases for the first 9 (nine) months from your account opening, on some cards.

- You have to pay an annual percentage rate (APR) up to 13.99% to 23.99% variable APR on your purchases.

- You are offered free employee cards with spending limits, on these cards.

- The foreign transaction fee is $0 (no fee), using these cards.