How to Apply for Indigo Platinum Mastercard

This article is regarding the Indigo Platinum Mastercard. Through this article, we will discuss everything you need to know about the process of Indigo Card Apply. So, if you received an invitation code and want to apply for this credit card, then you should read this article for complete details.

About Indigo Platinum Mastercard

If you have a poor credit score or no credit history at all, then it will be difficult for you to get qualified for a credit card, mainly if you don’t want to put down a deposit to secure the card. Indigo Platinum Mastercard is a good option for you and it does not require any security deposit. The credit limit of this credit card is $300 and you will be charged an annual fee of $75 for the first year and then $99 thereafter.

Key Benefits of Indigo Platinum Mastercard

Although this credit card does not have any rewards for its users. But these are some of the following benefits that you will get with this Indigo card:

- You can check if you qualify or not, without harming your credit score

- They let you choose the design of your credit card, without any additional fee

- You will get mobile access 24/7

- This credit card comes with chip card technology, which adds an extra layer of security to your card

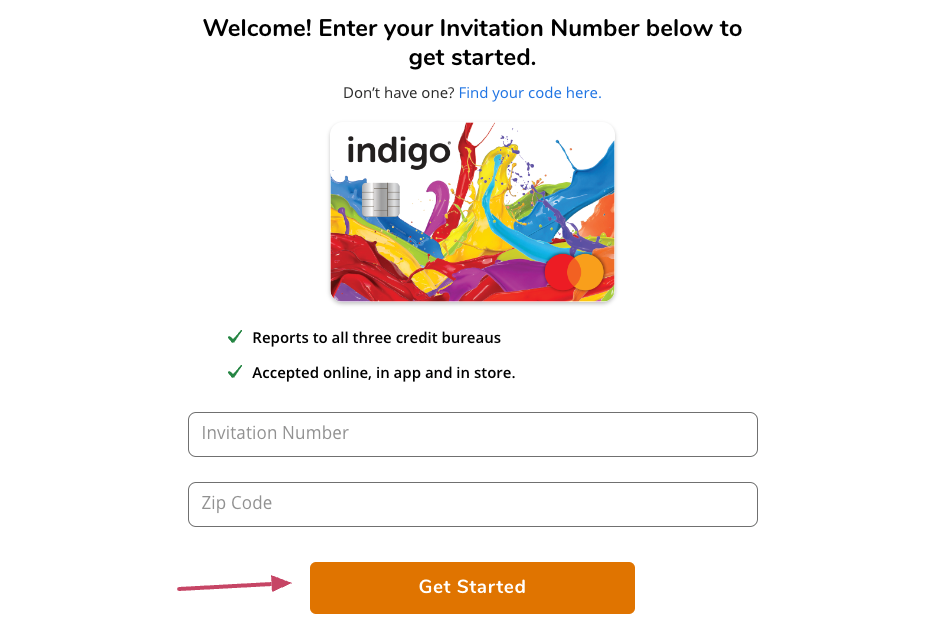

Step by Step Guide for Indigo Card Apply with Invitation Code

You can easily apply for the Indigo Platinum Mastercard with the invitation number. If you didn’t receive a mail offer, then you should check if you are pre-qualified for a personal credit card. You have to follow these simple instructions below to apply for the Indigo Platinum Mastercard:

- Firstly, you have to visit this link indigocard.com/invite.

- The above-mentioned link will redirect you to the Indigo Card application page.

- There, on the given fields, you have to input your invitation number and zip code.

- After entering the required details on the given fields, simply select the Get Started option.

- Then, you can simply follow the on-screen guideline to complete the application for Indigo Platinum Mastercard.

Rates and Fees of Indigo Platinum Mastercard

Interest Rates and Charges

- APR for Purchases: The purchase APR of this card is 24.9%.

- APR for Cash Advance: The cash advance APR of this card is 29.9%.

- Minimum Interest Charge: Minimum interest of this card is no less than $1.00.

Fees

- Annual Fee: The annual fees will vary between $75 to $99.

- Cash Advance Fee: For each cash advance, you will be charged 5% of the amount of a minimum of $5, whichever is greater.

- Foreign Transaction Fee: For each transaction, you will be charged 1% in U.S. dollars.

- Late Payment Fee: If you fail to pay your credit card bill by the due date, then you will be charged up to $40.

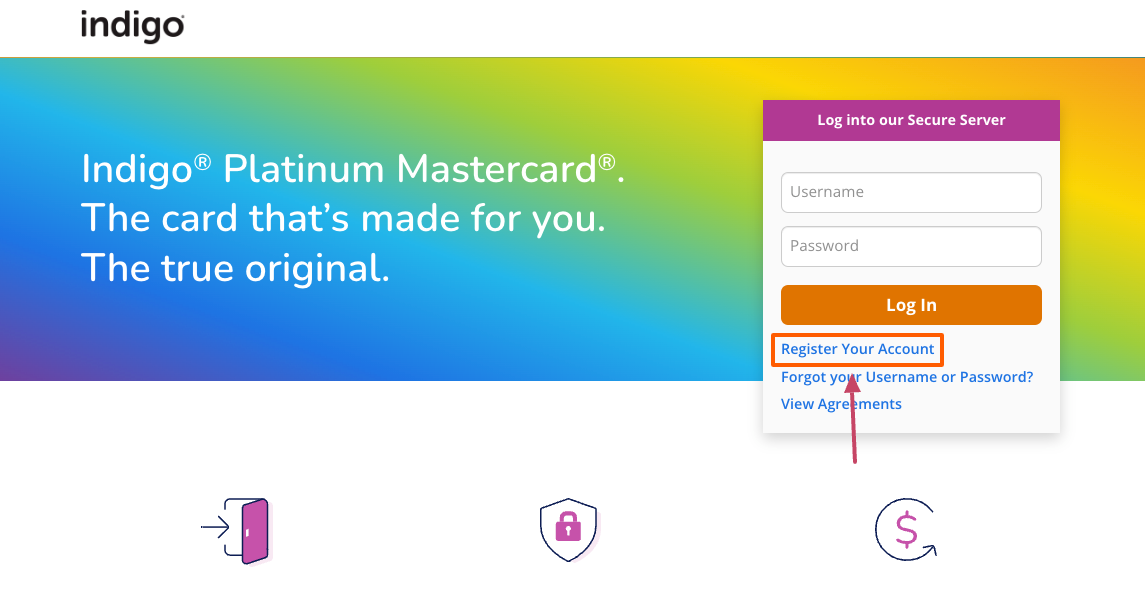

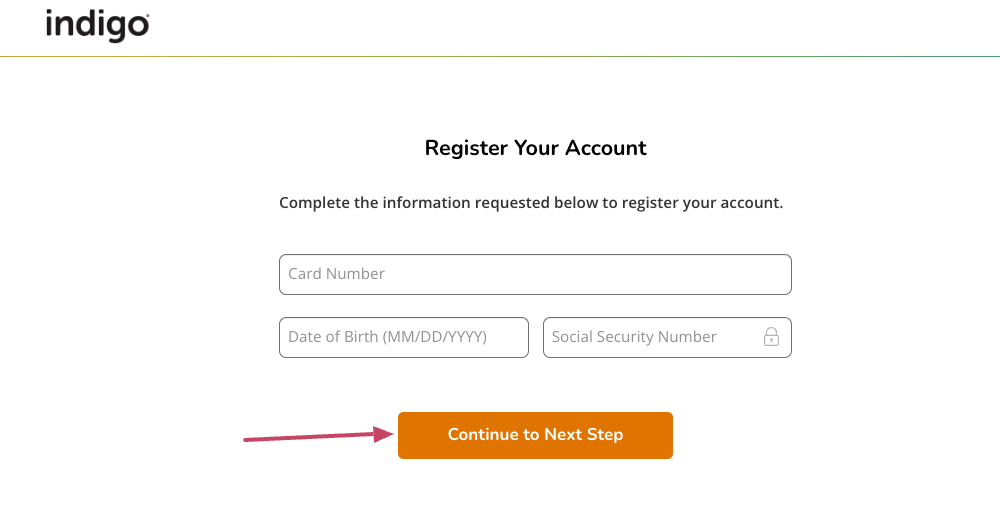

How to Register Your Indigo MasterCard

In order to manage your Indigo Platinum Mastercard or make the payment for your card bill, you have to register your online account. You have to follow these easy instructions below to register your Indio Card account

- Firstly, you have to visit this link myindigocard.com

- Then, there you have to click on the Register Your Account button.

- On the page, provide your account number, date of birth, and social security number.

- After entering all the required details on the given spaces, you just have to select the Continue to Next Step button.

- Then, you can simply follow the on-screen guideline to register your Indigo Card

Also Read

Online guide for Citizens Bank Card Activation

Manage your Macy’s Credit Card Login Account

How to Make the Payment for Indigo Platinum Mastercard Credit Card Bill

There are several options available to make the payment for your Indigo Platinum Mastercard. You can choose any of the following methods below to complete your payment for your credit card bill.

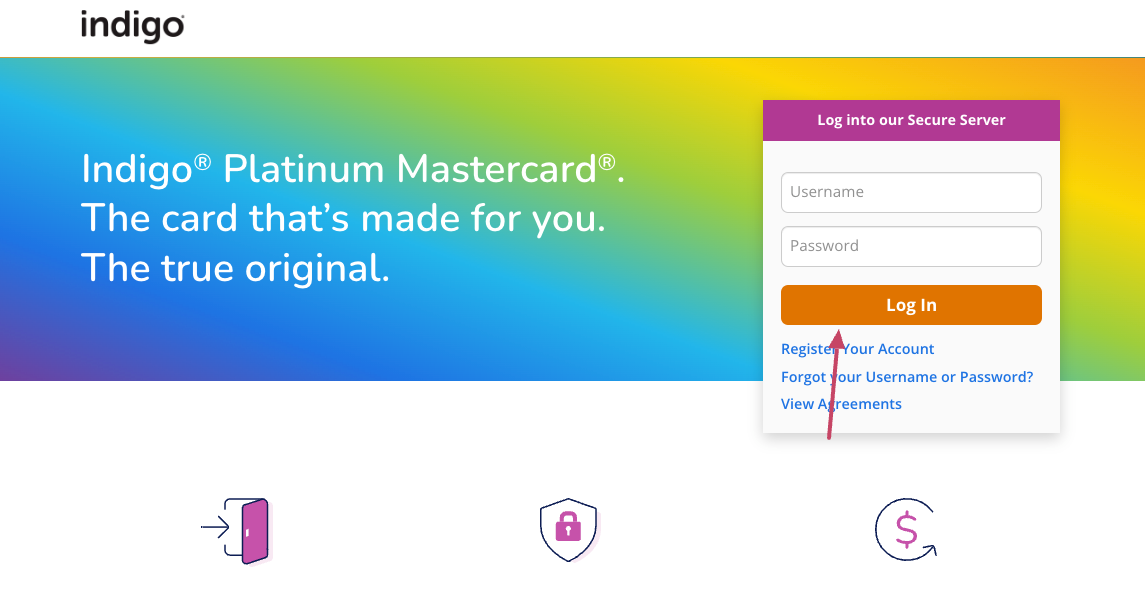

Online Payment Method

Before going further, make sure that you have already registered for the credit card online access. You must have your login credentials to make the payment for the Indigo Card bill through the online method. You have to follow these easy instructions below to make the payment for your Indigo Platinum Mastercard bill:

- Firstly, you have to visit this link myindigocard.com

- The above-mentioned link will redirect you to the Indigo Card login page.

- There, you have to provide your valid username and password in the given spaces and click on the Login button.

- After entering your Indigo card login credentials in the given spaces, you just have to select the Log In button.

- Once you logged in to your account, you just have to look for the online payment option.

Pay by MoneyGram

They also accept credit card bill payments via the MoneyGram location. You have to visit any of your nearest MoneyGram locations to make the payment for your Indigo Card bill. You can use the company name Genesis FS Card Service and receive code 4911. In order to find out your nearest MoneyGram location, you can visit www.moneygram.com.

Pay by Phone

Indigo Credit Card users can make credit card payments over the phone. To make the payment for your credit card bill, you have to call 866-946-9545 on your phone. After calling on this number, you just have to follow the on-screen guideline to complete your credit card bill payment.

Indigo Credit Card FAQs(Frequently Asked Questions)

Who can apply for the Indigo Mastercard?

Anyone who is interested in establishing or rebuilding their credit score can apply for this credit card. To get pre-qualified or approved, you must meet the following criteria:

- You must have to be at least 18 years or older, need a valid social security number, physical address, and a US IP address

- You must meet the additional credit qualification criteria, which include a review of your income and your debt, and identity verification requirements.

How do I pre-qualify for the Indigo Mastercard?

It is quite easy to see if you are pre-qualified. You have to submit the quick pre-qualification form and get the result within minutes. You have to visit this link www.indigocard.com/pre-qualify.

Can I apply over the phone?

Yet, there is no application by phone service at this time. You must have to complete the online pre-qualification form to get started. For assistance, you can contact the customer service department at 1-800-353-5920 (from 6:00 am to 6:00 pm, Pacific Time, M-F).

When will I receive my card?

In most cases, your new card will arrive within 14 business days of being approved.

What if I don’t receive my card within two weeks?

If you do not receive your card within 21 days after being approved, you have to contact the customer service department at 1-800-314-6340. Indigo customer service is available 24 hours a day, seven days a week.

Conclusion

So, this is all about the Indigo Platinum Mastercard. Through this article, we have tried to provide all the important details that you need to know about the Indigo Platinum Mastercard. But still, if you have any questions about the application process, then you can contact the customer service department for help.