Desjardins – An Introduction

The historical backdrop of Desjardins Group has completely interlaced with that of present-day Quebec. For more than 100 years now, the improvement of the Desjardins organization and the expansion of its operations resembled the social and period of prosperity of the area. Desjardins, one of the greatest monetary gatherings in Canada today, has consistently been consistent with the way of thinking of its founder, to add to the prosperity of people and neighborhood.

As a Worldwide Co-operative Alliance part, Desjardins has similar goals and beliefs as a large number of cooperatives around the globe. These goals and beliefs are communicated through a bunch of qualities that characterized the helpful personality from the very beginning.

Since each helpful works has its circle of action, Desjardins, as a co-operative monetary group, has recognized qualities that control the choices and activities of everybody inside the association to guarantee that their vision and mission are carried out properly. It is one of the largest financial co-operative financial institutions in Canada.

How to Apply for Desjardins Visa Credit Cards:

To apply for a Desjardins Visa credit card the users have to follow the steps:

- Firstly, the users have to go to their official website or can click on the link www.desjardins.com.

You have to click on the “Personal” section under the organization name.

- Now select “Cards, Loans, and Credit”.

Diverted to a new webpage.

Here, select the “Credit cards” option under the Cards section.

Again on a new webpage, you will find their variety of cards to choose from.

Click on the “Get this product” option to apply and follow the process.

How to Activate a Desjardins Visa Credit Card:

If the user is a new cardholder or if their first purchase transaction doesn’t need a terminal (online, contactless, or pre-authorized payment) they can activate the card over the phone.

The users have to call 514 -397 -1580 or 1 -888 -389 -7823.

They have to follow the simple instructions to activate their card using the 8 digit control number written under their card.

The users don’t need to talk to any agents.

- The users are advised to sign the back of their respective cards as soon as they complete the activation process.

- If the user has ordered more than one card, they can activate their cards under their accounts.

For renewing a new card from an old card – The cardholder has to simply use their Desjardins Credit card for a purchase or cash advance at a terminal, using their same personal identification number (PIN) as they have on their old card.

Activation via Phone:

You can use your registered phone number to activate the card, contact Customer Service at 1 -877 -847 –VISA (1 -877 -847 -8472).

Activation over the phone can be done, for Members of the Montreal area call 514 – CAISSES (514 -224 -7737), for elsewhere in Canada and the United States call 1 -800 –CAISSES (1 -800 -224 -7737), for Non-members call 1 -877 – 847 -8472, and for Students call 1 -800 -667 -7972.

Also Read : Manage your Sears Credit Card Online

Various Credit Cards by Desjardins:

There are many Credit cards offered by the Desjardins group. Some are briefly discussed below:

Students Cash Back Credit Cards:

Students Cash Back Visa Card

Features and Advantages:

- Students can avail of up to 2% cashback on their transactions in the following categories restaurants, entertainment, public transportation, and pre-authorized payments.

They can also get 0.5% more cashback on their other purchases.

The user’s account is automatically credited when they accumulate $25 cashback.

The users also can get more cash back, if they make transactions from the registered participating merchants on the website.

Rates and Interests:

The cardholders are charged $0 (free) as Annual fees.

The charge for an additional card is $0 (free).

The users have to pay 19.9% as interest rates on their purchases.

Students Cash Back Master Card

Features and Advantages:

- Students can avail of up to 2% cashback on their transactions in the following categories restaurants, entertainment, public transportation, and pre-authorized payments.

They can also get 0.5% more cashback on their other purchases.

The user’s account is automatically credited when they accumulate $25 cashback.

The users also can get more cash back, if they make transactions from the registered participating merchants on the website.

Rates and Interests:

The cardholders are charged $0 (free) as Annual fees.

The charge for an additional card is $0 (free).

The users have to pay 19.9% as interest rates on their purchases.

Students Bonus Visa Credit Card

Features and Advantages:

Students can avail of up to 2% cashback on their transactions in the following categories restaurants, entertainment, public transportation, and pre-authorized payments.

They can also get 0.5% more cashback on their other purchases.

The users also can get more cash back, if they make transactions from the registered participating merchants on the website.

Rates and Interests:

The cardholders are charged $0 (free) as Annual fees.

The charge for an additional card is $0 (free).

The users have to pay 19.9% as interest rates on their purchases.

Students Odyssey Gold Visa Credit Card

This attractive card is offered by the company, dedicatedly for university students. The students can visit this card option and have to select their respective field of study to apply for the card.

Features and Advantages:

A free monthly plan with a facility for unlimited transactions.

A line of credit facility, at an attractive rate.

A credit card full of rewards.

Exclusive advantages and discounts are offered for the Desjardins members.

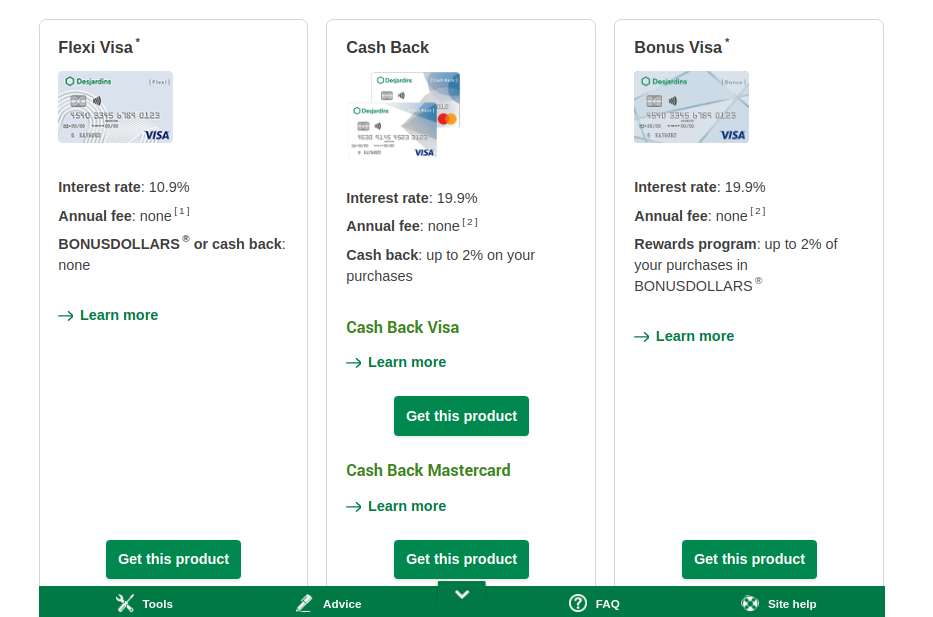

Desjardins Low-Interest Rates Credit Cards:

Flexi Visa Credit Cards

Features and Advantages:

Fast financing for whatever the users required.

The users can get up to a Cash advance of $5,000 a day, on a 10.9% interest.

They can avail of insurance up to $1,000 to cover the loss, theft, accidental damage, or mechanical failure of their mobile devices purchased using this card.

Purchase protection and extended warranty for some particular items are also available.

Travel insurance for trips up to 3 (three) days is available with this card. The users will get covered in case their trip gets canceled or interrupted if they lose their baggage or they required emergency healthcare.

Fraud protection is available with zero liability in the event of fraud. The users won’t be held responsible for any fraudulent purchases charged to their account.

Rates and Interests:

The cardholders are charged $0 (free) as Annual fees.

The charge for an additional card is $0 (free).

You have to pay 10.9% as interest rates on their purchases.

Odyssey Visa Infinite Privilege Credit Cards

Features and Advantages:

- The cardholders can get up to 4% in BONUS DOLLARS, making transactions in restaurants, entertainment, and public transportation, etc.

- The users can get up to 3% in BONUS DOLLARS, making transactions in groceries, and travel, etc.

They can avail of 1.75% BONUS DOLLARS on other purchases also.

- The end users can get comprehensive travel insurance for up to 60 (sixty) consecutive days, for themselves and their families.

They can avail of insurance up to $1,000 to cover the loss, theft, accidental damage, or mechanical failure of their mobile devices purchased using this card.

Purchase protection and extended warranty for some particular items are also available.

Fraud protection is available with zero liability in the event of fraud. The users won’t be held responsible for any fraudulent purchases charged to their account.

The users can avail 100% coverage for their assets and a fraud support service, along with this card.

Rates and Interests:

The cardholders are charged $295 as annual fees for members.

The charge is $395 as annual fees for non-members.

The charge for an additional card is $0 (free) for members.

Non-members have to pay $95 for an additional card.

You have to pay 9.9% as interest rates on their purchases.

Desjardins Cash Back Credit Cards:

If the user has an income of less than $80,000 (personal), less than $150,000 (household), and assets under management less than $400,000, they can choose from 2 (two) options:

Cash Back Visa Card

Cash Back Master Card

If your income is $80,000 or more (personal), a $150,000 or more (household), or assets under management of $400,000 or more, then you can choose:

Cash Back World Elite Master Card

Desjardins Bonus Dollars Credit Cards:

If the user has an income of less than $80,000 (personal), less than $150,000 (household), and assets under management less than $400,000, they can choose from 2 (two) options:

Bonus Visa Card

Odyssey Gold Card

If your income is $80,000 to $149,999 (personal), a $150,000 to $199,999 (household) or assets under management $400,000 or more, you can choose from 2 (two) options:

Odyssey World Elite Master Card

Odyssey Gold Visa

If the end-user has an income of $150,000 or more (personal), a $200,000 or more (household), or assets under management of $400,000 or more, then they can choose from 3 (three) options:

Odyssey Visa Infinite Privilege Card

Odyssey World Elite Master Card

Odyssey Gold Visa Card

Desjardins Travel Perks Credit Cards:

If your income is less than $80,000 (personal), less than $150,000 (household), and assets under management less than $400,000, you can choose:

Odyssey Gold Visa Card

If the user has an income of $80,000 to $149,999 (personal), a $150,000 to $199,999 (household) or assets under management $400,000 or more, they can choose from 2 (two) options:

Odyssey World Elite Master Card

Odyssey Gold Visa Card

If the income is $150,000 or more (personal), a $200,000 or more (household), or assets under management of $400,000 or more, then the customer can choose from 3 (three) options:

Odyssey Visa Infinite Privilege Card

Odyssey World Elite Master Card

Odyssey Gold Visa Card

Desjardins No Annual Fee Credit Cards:

Cash Back Visa Card

Features and Advantages:

- The cardholders can avail of up to 2% cash back on their transactions in the following categories restaurants, entertainment, public transportation, and pre-authorized payments.

They can also get 0.5% more cash back on their other purchases.

The user’s account is automatically credited when they accumulate $25 cash back.

The users also can get more cash back, if they make transactions from the registered participating merchants on the website.

Rates and Interests:

The customers are charged $0 (free) as Annual fees.

The charge for an additional card is $0 (free).

The users have to pay 19.9% as interest rates on their purchases.

Cash Back Master Card:

Features and Advantages:

- The customers can avail of up to 2% cash back on their transactions in the following categories restaurants, entertainment, public transportation, and pre-authorized payments.

You also get 0.5% more cash back on your other purchases.

- The end user’s account is automatically credited when they accumulate $25 cash back.

- Consumers also can get more cash back, if they make transactions from the registered participating merchants on the website.

Rates and Interests:

The cardholders are charged $0 (free) as Annual fees.

The consumers have to pay $0 (no fee) for an extra card.

The users have to pay 19.9% as interest rates on their purchases.

Bonus Visa Credit Card

Features and Advantages:

- The cardholders can avail of up to 2% cash back on their transactions in the following categories restaurants, entertainment, public transportation, and pre-authorized payments.

The customers can also get 0.5% more cash back on their other purchases.

- The end users also can get more cash back, if they make transactions from the registered participating merchants on the website.

Rates and Interests:

The customers are charged $0 (free) as Annual fees.

The charge for an additional card is $0 (free).

The end users have to pay 19.9% as interest rates on their purchases.

Flex Visa Credit Card

Rates and Interests:

You will be charged $0 (no fee) as Annual fees.

There is $0 (no fee) for an additional card.

The customers have to pay 10.9% as interest rates on their purchases.

Desjardins Credit card – How to Log in:

- Firstly, the users have to go to their official website or can click on the link www.desjardins.com.

Then, click on the “Log on” button under the Online services.

Now the end-users will be diverted to a new webpage.

Here they have to put on “Username” i.e. their (Card number or User code).

- Then the users have to press “Go” and follow the instruction to complete the process.

Contact Details:

Head Office Address:

Desjardins Financial Centre

11, King Street West

Toronto, Ontario

M5H 4C7

Office Phone number (Call): 416 -867 -3600 or 1 -855 387 -3600

Montreal Area (Call): 514 -397 -4415

Report for Card lost or Stolen (24X7) 7 days a week.

Users can change their address or can get accounts information (Monday to Friday 7 am – 8 pm) and on (Saturday to Sunday 8:30 am to 5 pm).

Canada and U.S. (Call): 1 -800 -363 -3380

For Collect (Call): 514 -397 -4610

Reference Link: